How Sales Enablement drives Sales for Investment Banking

Clients don’t want generic advice anymore.

With so many online resources at their disposal, clients can conduct market research, access financial data, and compare options independently.

To help your client-facing reps compete, they need a single source of truth for training, campaigns, and content to demonstrate authority and provide standout client experiences.

Let’s get into more detail.

What’s preventing investment bankers from selling effectively and winning deals today?

1. Relevant sales collaterals are hard to find.

There’s too much content scattered across emails, drives, and chats.

Investment banks often operate in silos, with different departments (e.g., M&A, Sales & Trading, Debt, Equity) storing content independently.

This content would include research reports, pitch books, training materials, compliance documents, and more…that’s A LOT of content.

Without a single source of truth - client-facing reps can struggle to find the right content quickly, leading to delays and inefficiencies. It also results in missed opportunities for cross-selling and upselling, as sales teams might not be aware of all available resources.

Additionally, this can hamper onboarding and training efforts, as new employees may find it challenging to locate necessary resources.

2. Highly sensitive documents = costly security risks.

Email and drive links are simply not secure enough.

Investment banking involves handling highly sensitive and confidential information like client proposals, financial models, and due diligence reports.

They also operate under stringent regulatory requirements. Non-compliance due to mishandling of sensitive data can result in hefty fines and reputational damage.

This means traditional methods of sharing documents, such as email and drive links, are not always secure enough and can lead to data breaches. Additionally, when documents and information are scattered across different platforms and personal drives, it increases the risk of data breaches.

Unauthorized copies can be made, and outdated or incorrect information can be used, leading to security vulnerabilities.

3. No tools to deliver personalized experiences.

Email and drive links are simply not secure enough.

Given the high stakes involved, it’s only fair that investment banking clients expect highly personalized services tailored to their unique needs and preferences. For that matter, 70% of high-net-worth individuals (HNWIs) globally expect more personalized services from their wealth managers.

However, delivering such personalized experiences at scale can be challenging, especially for boutique and mid-sized firms, given the diverse clientele and the complexity of financial products.

However, the lack of personalization can lead to lower client satisfaction and engagement which will in turn have a significant impact on revenue.

4. Sales cycles are too long.

Complex deals + multiple stakeholders + due diligence = extremely long sales cycles.

The sales cycles in investment banking are notoriously long, often ranging from 3 months to 2 years. This is due to the complexity of deals, the need for extensive due diligence, and the involvement of multiple stakeholders.

Long sales cycles can drain resources and reduce the efficiency of sales teams. Without a structured approach to managing this, engagement can wane, and competitors can swoop in because salespeople lack the necessary resources and guidance to keep clients informed and engaged throughout the process.

This can also lead to uncertainty and decreased motivation among sales teams.

What could sales enablement mean for Investment banking

Sales enablement for investment bankers would involve equipping sales reps with the tools, resources, training, and information needed to effectively engage clients, build trust, manage relationships, and execute transactions.

All this without an extensive tech stack and endless meetings and email threads.

Here’s how a sales enablement tool can help investment bankers:

Making content more easily accessible:

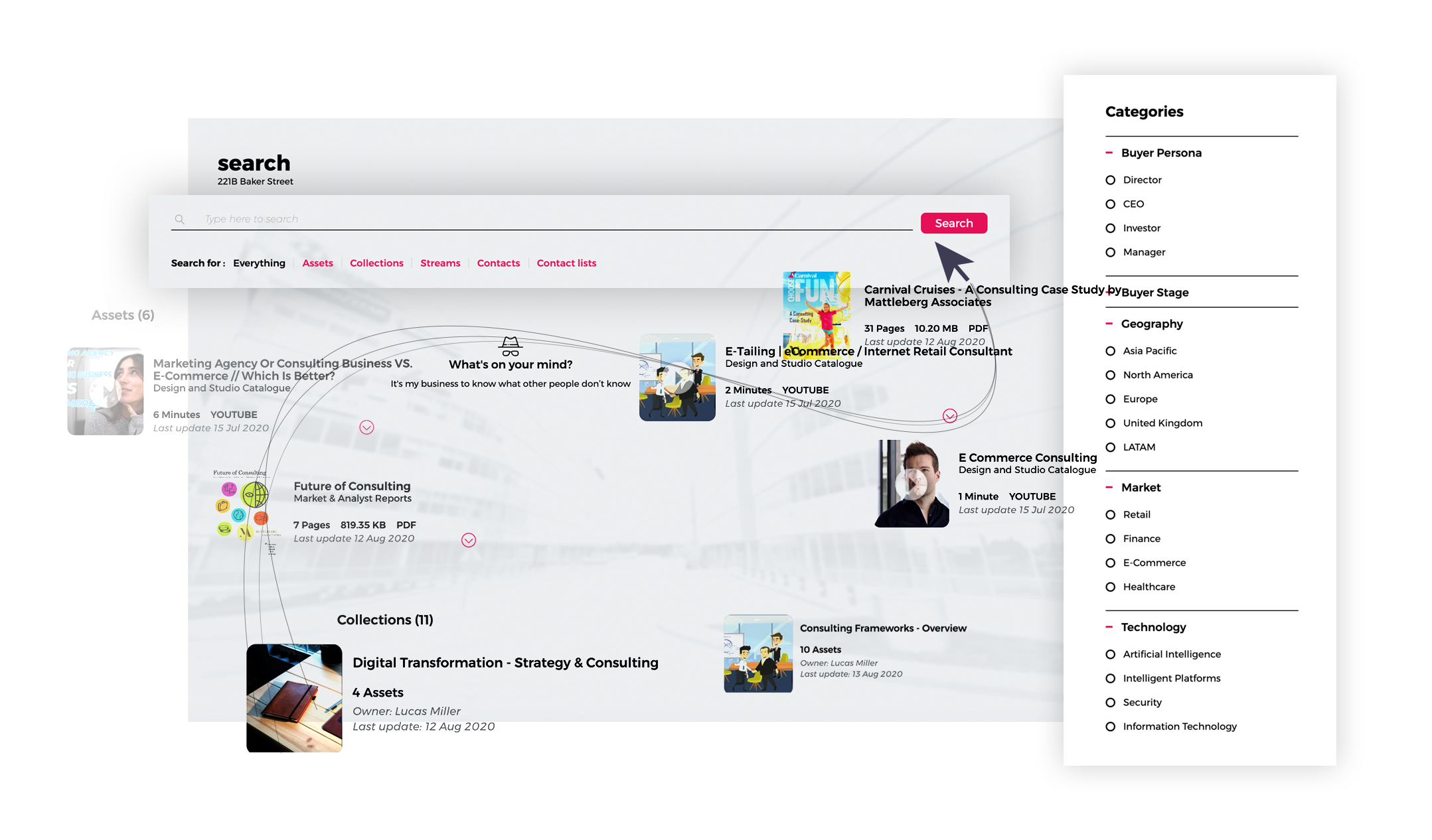

Implementing a centralized content management platform can help ensure that all departments have access to the same up-to-date information, improving collaboration and consistency.

A robust content management system (CMS) will provide a single source of truth for the sales teams, where all content is organized, searchable, and easily accessible. This improves productivity and ensures that sales teams can quickly find the information they need.

Being able to store and share documents securely:

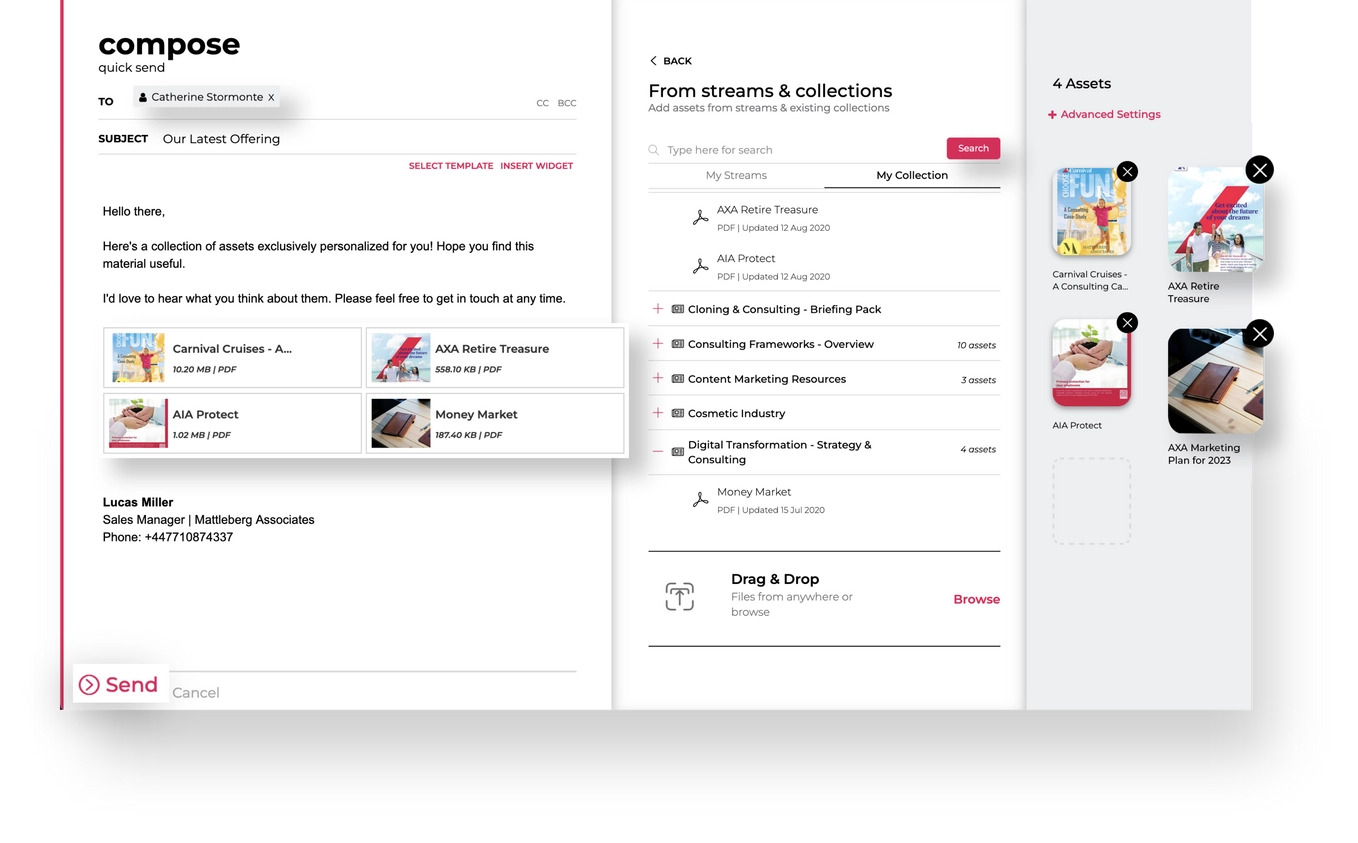

Having a secure content management platform that integrates with all your other tools like CRM, Email provider, and communication channels and allows sales teams to allow sales teams with secure document-sharing capabilities ensure that sensitive information is protected.

Features like encryption, password protection, and access controls can reduce the chances of unauthorized document copies floating around and ensure that all team members are working with the most current and accurate information.

Centralized content also makes it easier to enforce and monitor security policies across the entire organization. They also create an audit trail that helps in monitoring and securing document access.

Analytics and data that helps understand client needs:

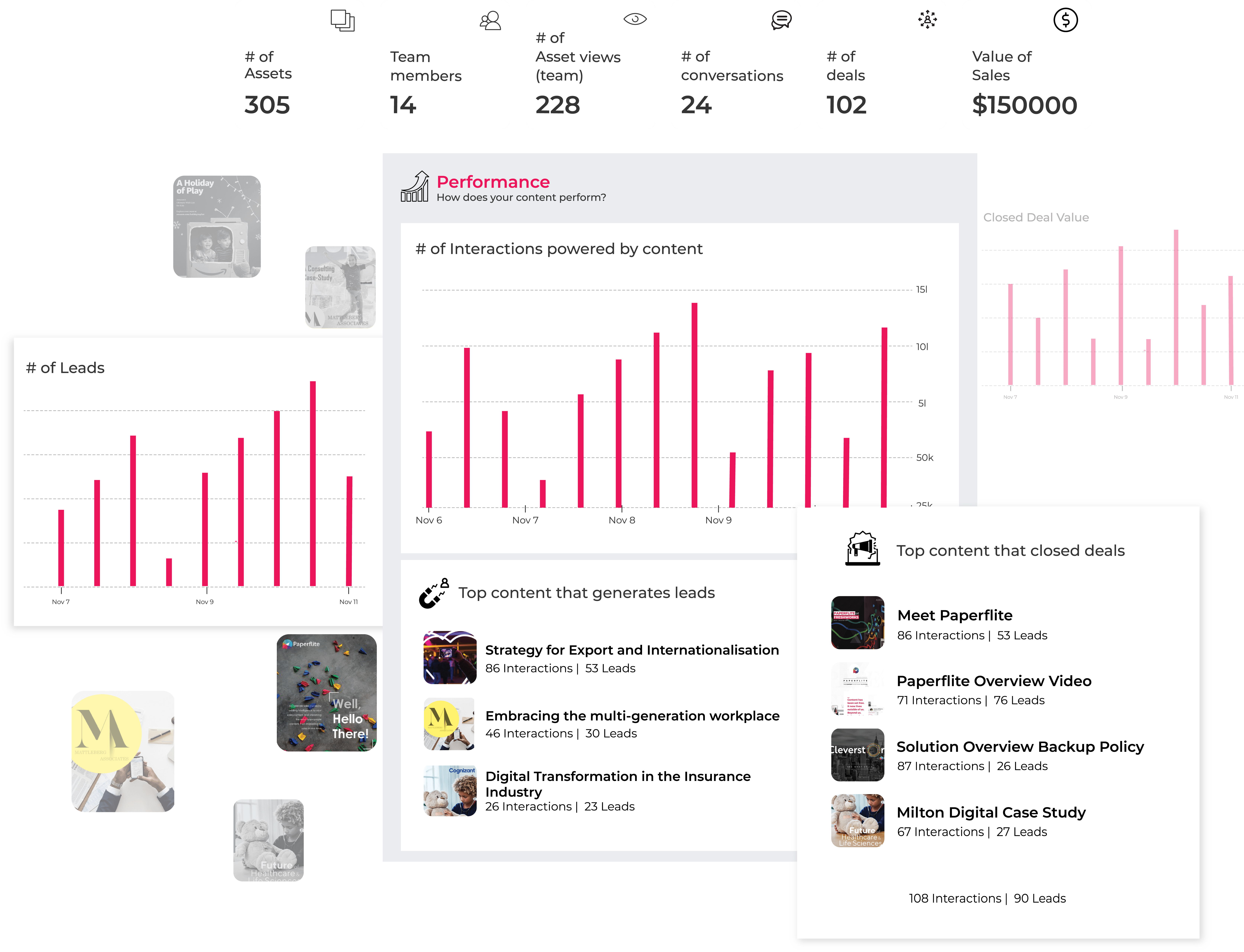

A sales enablement platform constantly tracks all interactions and content exchanges. These insights and recommendations help share personalized content and improve client engagement and satisfaction.

Sales enablement platforms also track the effectiveness of marketing and sales efforts by linking content usage to deal outcomes. This provides clear metrics to measure ROI and optimize strategies.

Delivering personalized experience:

Sales enablement platforms can provide data insights into client behaviours and preferences, enabling sales teams to deliver personalized content and communications.

This can improve client relationships and increase the chances of closing deals. For example, understanding which products the clients are interested in based on their interactions with the shared content and tailoring follow-ups based on it can significantly enhance client satisfaction.

Paperflite - a secure and comprehensive Sales Enablement Solution for Investment Banks

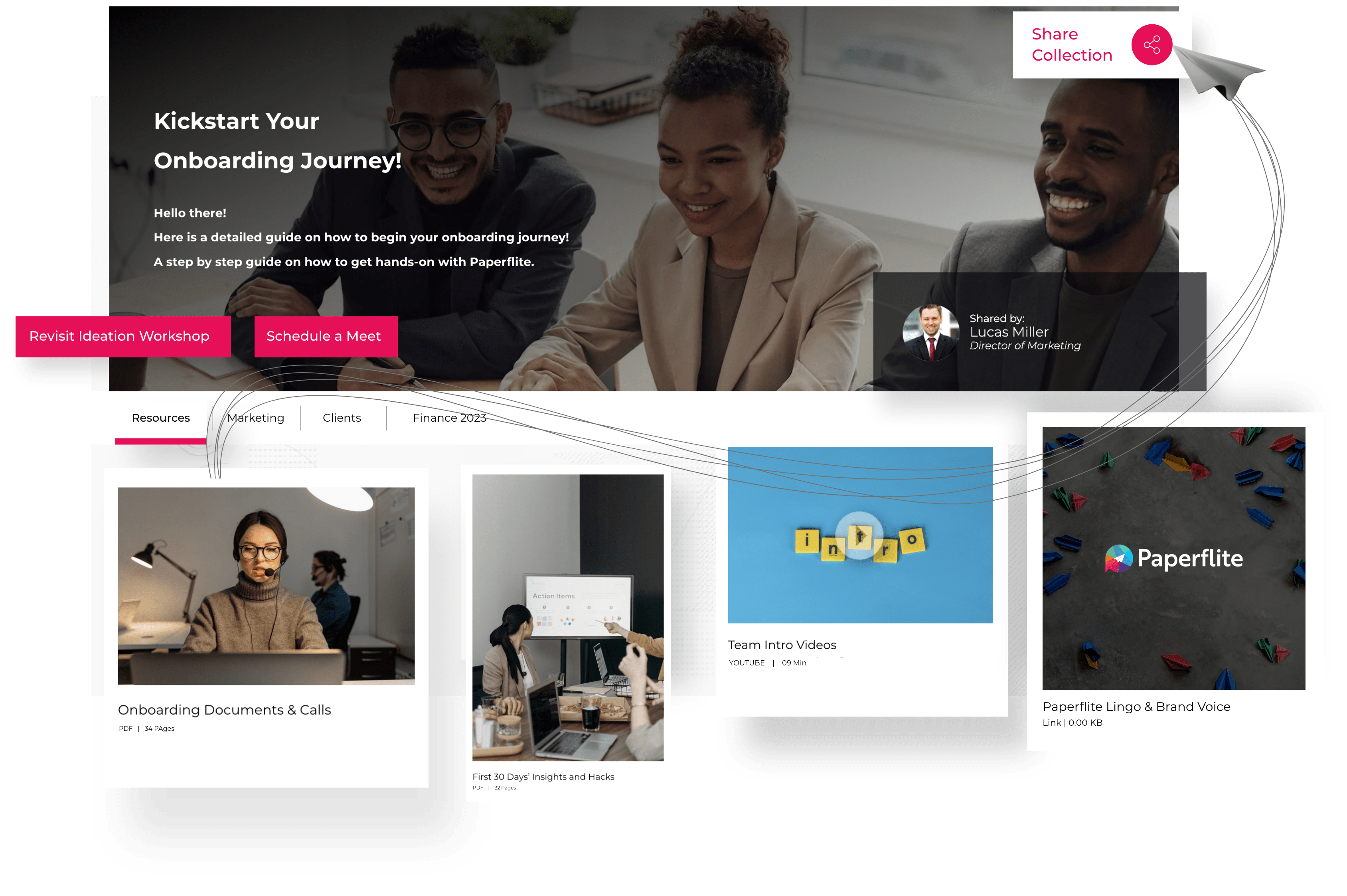

Paperflite is designed to meet the needs of financial service businesses by providing sales teams with the right access to the right content at the right time.

The platform centralizes all sales materials, allowing product, marketing, and sales enablement teams to securely store content in access-controlled silos. This is especially beneficial for complex organizations with multiple products like investment banks.

Its AI-powered search and content recommendations help sales reps find the best materials for specific use cases and provide accurate answers to their questions, even during client meetings.

The platform is also GDPR, HIPAA, and SOC2 compliant, undergoing regular audits to maintain the highest standards of data security and regulatory compliance.

Looking for a Sales Content Management Platform that addresses the unique challenges faced by the finance industry? Talk to us!

Features like content collections and 'live collection' enable sales teams to create personalized microsites and keep all stakeholders updated in real time, ensuring everyone involved in a deal remains on the same page.